Several startups I’ve spoken to this year told me they have been considering holding their seed investment money in stablecoins, such as USDC and USDT, so they can earn passive income by lending out the coins to others. The interest rates are as high as 20% right now, looking very tempting compared to 0.5% for savings accounts.

If you actually choose to do this, tell your investors so they know what they are getting into.

To receive such a high-interest rate, there are two risks involved:

- The risk of holding a stablecoin. This appears somewhat safe in some cases.

- The risk of lending out the stablecoin, which is where the interest comes from. This is extremely risky in all cases I have seen

Many seem to be confusing the potentially lower risk of holding a stablecoin with the high risk of lending or staking it out for interest — a confusion lenders are playing up.

For example, Circle offers “secured” term investments of up to 5%, based on a 12-month term, yet the link on its Yield product page (https://www.circle.com/en/products/yield) points to Grant Thorton’s attestations of USDC for their transparency and compliance. Those transparency reports have nothing to do with the major risk of this lending program, which I’ll get into more below

Risk of Holding Stablecoins

The risk of holding a stablecoin is whether it can maintain the original value of $1 USD when you cash out. The only way to ensure that outcome is for a stablecoin issuer to hold 100% collateral. For every stablecoin worth $1 USD, the stablecoin company reserve would have the ability to give you 1 real US Dollar.

If the money they hold is anything riskier than cash or Treasury bills, they risk a run on the bank. Look at what happened to the Reserve Primary Fund holding “low-risk commercial paper”: https://en.wikipedia.org/wiki/Reserve_Primary_Fund

There are currently no laws on this. Some stablecoins have put a lot of effort into showing their collateral while algorithmic stablecoins, such as UST, have no collateral at all. Because US dollars are not on the blockchain, you cannot lock them into a smart contract. Any of them can change their reserves at any time.

This year a law was drafted to address stablecoin collateralization. It would force all stablecoins to hold 100% collateral in FDIC-insured bank accounts. It has not been passed and even if it does, it will not be put into effect until up to 1 year from that date.

Link to Stablecoin Innovation and Protection Act of 2022:

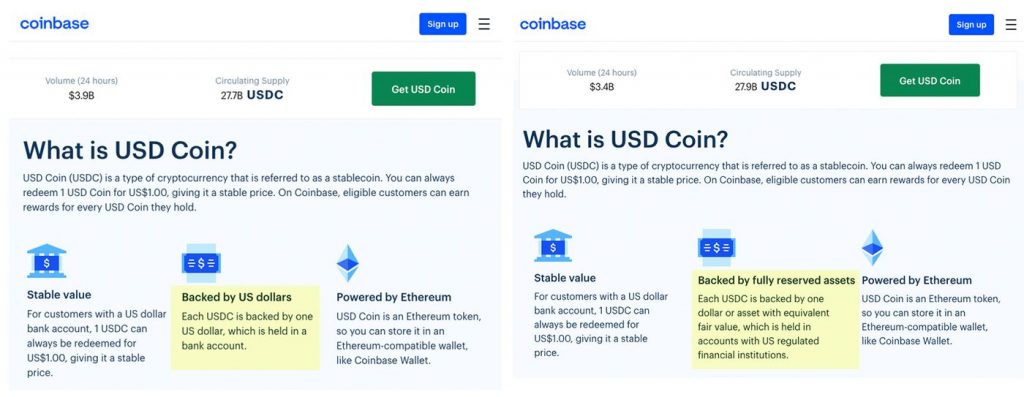

In lieu of a real law, you can look at a stablecoin’s transparency report and see which accounting firm is attesting to their transparency report. You cannot trust whatever the stablecoin company writes on their website. There is no consequence for wrongly stating their own reserves: https://www.bloomberg.com/news/articles/2021-08-11/coinbase-drops-promise-of-token-s-cash-backing-that-wasn-t-true

In case you don’t have a subscription to Bloomberg – A Coinbase spokesman pointed to a blog post (https://blog.coinbase.com/fact-check-usd-coin-is-the-largest-regulated-stablecoin-in-the-world-6e7f3c06cbf0) from earlier this month that said USD Coin’s reserves comply with regulatory requirements. On the day Bloomberg News contacted the company, some of the language describing USD Coin’s assets on its website changed.”

Top Stablecoins by Market Cap

Coinmarketcap lists the top stablecoins by market cap: https://coinmarketcap.com/view/stablecoin/

Tether (USDT)

Link to Transparency Reports:

Every Quarter: https://tether.to/en/transparency/#reports

Their most recent transparency report:

Summary:

Of their $78,675,642,677 in USDT, they have $38,714,890,620 (or 49%) in cash and treasury bills. The rest is in opaque, potentially risky investments from loans to other cryptocurrencies. You can see the breakdown in the report.

Accounting firm behind their transparency report:

Their transparency report is attested by MHA Cayman, a 17-year-old accounting firm at a P.O. Box in the Cayman Islands. Tether is currently battling three class-action lawsuits including the New York State Attorney General.

USD Coin (USDC)

Link to Transparency Reports:

Every month: https://www.centre.io/usdc-transparency

Their most recent transparency report: https://www.centre.io/hubfs/PDF/2022%20Circle%20Examination%20Report%20February%202022.pdf?hsLang=en

Summary:

They used to clearly state all reserves were 100% held in dollars with a reserve breakdown in October:

Since then, they have changed their wording to say they “fulfill the company’s obligations…as a money transmitter licensed in various US states and territories.”

Money transmitter licenses completely depend on the state. Some states are very strict while states like New York and Connecticut “allow money transmitters to invest in commercial paper and preferred shares of publicly listed companies.”

Centre, the company behind USDC, is co-run by Coinbase and Circle. Check out Coinbase’s user agreement (since removed) for how many state money transmitters “Do not cover the transmission of virtual currency.”

Under “APPENDIX 4: State License Disclosures”:

They appear to be planning to work with Bank of New York Mellon soon in anticipation of the stablecoin law eventually passing: https://www.pymnts.com/cryptocurrency/2022/bill-requiring-100-percent-cash-reserves-stablecoins-debuts-usdc-picks-bny-mellon-custodian/

Accounting firm behind their transparency report:

Grant Thornton is a nearly 100-year-old institution and part of the “Big 4” in the world.

Binance USD (BUSD)

Link to Transparency Reports:

Every month: https://paxos.com/attestations/

Their most recent transparency report: https://paxos.com/wp-content/uploads/2022/03/BUSD-Examination-Report-February-2022.pdf

Summary:

Their report states 100% back by U.S dollars or U.S. dollar equivalents. Details in the report. Same backing and company as USDP.

Accounting firm behind their transparency report:

Withum is a 48-year-old accounting firm in the USA.

TerraUSD (UST)

Link to Transparency Reports:

None, it maintains its price algorithmically in a smart contract.

Their most recent transparency report:

N/A

Summary:

There is 0% collateral as it uses an algorithm to determine its price.

Accounting firm behind their transparency report:

N/A

Dai (DAI)

Link to Transparency Reports:

Their collateral is always available on the blockchain.

At any time: https://daistats.com/#/collateral

Their most recent transparency report:

https://daistats.com/#/collateral

Summary:

0% of DAI collateral is backed by US dollars. Everything is backed by other cryptocurrencies.

Accounting firm behind their transparency report:

N/A

TrueUSD (TUSD)

Link to Transparency Reports:

At any time: https://real-time-attest.trustexplorer.io/truecurrencies

Their most recent transparency report: https://real-time-attest.trustexplorer.io/TrueUSD/report/7525c33e-a70c-454a-bf40-8f38802a5c80

Summary:

Nearly 0% of TUSD collateral is backed by US dollars.

Accounting firm behind their transparency report:

Armanino is a 70-year-old American accounting firm. They also have live links to their collateral wallets.

Pax Dollar (USDP)

Link to Transparency Reports:

Every month: https://paxos.com/attestations/

Their most recent transparency report: https://paxos.com/wp-content/uploads/2022/03/Paxos-Examination-Report-February-2022.pdf

Summary:

Their report states 100% back by U.S dollars or U.S. dollar equivalents. Details in the report. Same backing and company as USDP.

Accounting firm behind their transparency report:

Withum is a 48-year-old accounting firm in the USA.

Gemini (GUSD)

Link to Transparency Reports:

Every month: https://www.gemini.com/dollar

Their most recent transparency report:

Summary:

100% of GUSD collateral is held in a “money market fund managed by Goldman Sachs Asset Management, invested only in U.S. Treasury Obligations (including securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government)”

Accounting firm behind their transparency report:

BPM is a 40-year-old American accounting firm regarded to be in the top 50.

Risk of Lending Stablecoins

High stablecoin interest comes from two places:

- The loan interest rate of lending it out

- Staking rewards, as in the case of TerraUSD (UST).

If you are lending out a stablecoin, you are lending it in exchange for another cryptocurrency that doesn’t have any collateral. Many of these can (and have) gone to $0 USD in a short amount of time. Even if your loan is overcollateralized, another cryptocurrency becoming illiquid or falling in value fast and large enough could wipe out your entire loan.

This article talks about some risks like rehypothecation, which helped bankrupt the Lehman Brothers. There are legal limits in the non-crypto world: https://www.coindesk.com/layer2/2022/03/07/why-stablecoin-interest-rates-are-so-damn-high/

For staking rewards, the creator of a cryptocurrency is giving you a free % of coins as part of their protocol. You will notice this rate is highest with cryptocurrencies and stablecoins like UST that have 0% collateral backing them up. They can print at no cost.

Many lending and interest programs use LTV (loan-to-value) to show their collateral. For example, 50% LTV means twice the loan value is needed (200% collateral) before it attempts liquidation.

Most Popular Stablecoin Lending Programs

Here is a list of top places to lend your stablecoins: https://defirate.com/lend/

Notice the huge interest rate difference in the 100% collateral-backed stablecoin USDP vs USDT.

AAVE

Link: https://docs.aave.com/faq/liquidations

Collateral: Technically can be as little as 100% collateral of other cryptocurrencies. As of today, the lowest I saw was 115%.

Binance

Link: https://www.binance.com/en/loan

Collateral: Allows margin, so as little as 75% collateral of other cryptocurrencies

Bitfinex

Link: https://www.bitfinex.com/lending-products-start/

Collateral: Uses Celsius, so as little as 200% collateral of other cryptocurrencies

Blockfi

Link: https://blockfi.com/rates/

Collateral: As little as 200% collateral of other cryptocurrencies

Legal Notes:

As of February 14, 2022, BlockFi Interest Accounts (BIAs) are no longer available to new clients who are “U.S. persons” or persons located in the United States and such U.S. clients will be unable to transfer new assets to their BIAs.

Celsius

Link: https://celsius.network/crypto-loans

Collateral: As little as 200% collateral of other cryptocurrencies

Circle yield

Link: https://www.circle.com/en/products/yield

Collateral: Uses genesis, a centralized company with questionable collateral

Legal Notes:

***Not currently available in the following U.S. states: Alaska, Minnesota, New York and Hawaii.

Circle International Bermuda Limited

Coinbase

Collateral: For DAI, it is just their staking rewards so no collateral.

Other info:

Coinbase Lend program (canceled by the SEC)

Some interesting tweets and further links on this by the CEO of Coinbase and a Professor at Georgetown Law:

Compound

Link: https://compound.finance/markets under collateral factor

Collateral: Constantly changing, but technically as little as 100% collateral of other cryptocurrencies.

Fulcrum

Link: https://fulcrum.trade/

Collateral: Allows positions to be on 5x margin and collateral as low as 25%. In the case that you lose your original money, there is an insurance fund holding 10% of all interest being paid out on the platform.

Gemini

Link: https://www.gemini.com/earn

Collateral: Uses genesis, a centralized company with questionable collateral

Genesis

Genesis is a B2B lending platform that other lending companies use.

Link: https://genesistrading.com/wp-content/uploads/2022/01/Genesis21Q4QuarterlyReport-final3.pdf

Collateral:

“Genesis claims the interest it collects from borrowers entirely funds the interest it pays its lenders. Moro would not say whether it rehypothecates collateral. Genesis’ vice president of lending, Matt Ballensweig, said the firm makes some uncollateralized loans to “strategic partners,” but would not say how big a percentage of its loan volume was unsecured.”

Over the second half of 2021, we expanded our NFT-backed lending portfolio by underwriting loans backed by high quality, “blue-chip” NFT collateral.

The blue-chip NFT portfolio here is managed by the 1-year-old firm meta4 Capital (https://www.meta4.capital).

MakerDAO

Link: N/A as the LTV rates for loans can change at will.

Collateral: At the moment as little as 150% collateral from other cryptocurrencies.

Nexo

Link: https://support.nexo.io/hc/en-us/articles/360008116934-What-is-the-interest-rate-of-my-loan-

Collateral: In theory, they allow as little as 100% collateral of other cryptocurrencies(https://support.nexo.io/hc/en-us/articles/360008240893-What-Loan-to-Value-LTV-can-I-get-on-my-assets-).However, they mix in their own NEXO token for certain members as collateral which they can print at will meaning it can be much lower.

Poloniex

Link: https://support.poloniex.com/hc/en-us/articles/360039489954-Lending-Explained

Collateral: Collateralized by another cryptocurrency of your choice, potentially under 100% as they allow margin loans.

Terra

Link: https://www.stakingrewards.com/earn/terra/

Collateral: Anchor pays off based on the staking rewards of their other token LUNA so no collateral.

Venus

Link: https://venus.io/Whitepaper.pdf

Collateral: Creates VAI, a stablecoin backed by 200% collateral of other cryptocurrencies chosen by the users. Up to half of this collateral can be borrowed so it can be as low as 100% collateral.

Final thoughts:

For reference, Venmo, Cashapp, and Paypal aren’t in FDIC-insured accounts either (Zelle is). These cash apps hold all your money in USD and comply with money transmitter laws. This means they do not “print” money the way stablecoins can and have.

Are your employee salaries and bills in USD or stablecoins? If it’s in USD, you are taking a risk.

You are already on the risky path of starting your own business. You were lucky enough to raise a seed round and work on your startup full-time. Instead of doing the hard work of building your company, you are now betting the future of your company with stablecoins.

Did your investors give you money to build your company? Or to invest it for them in cryptocurrencies?