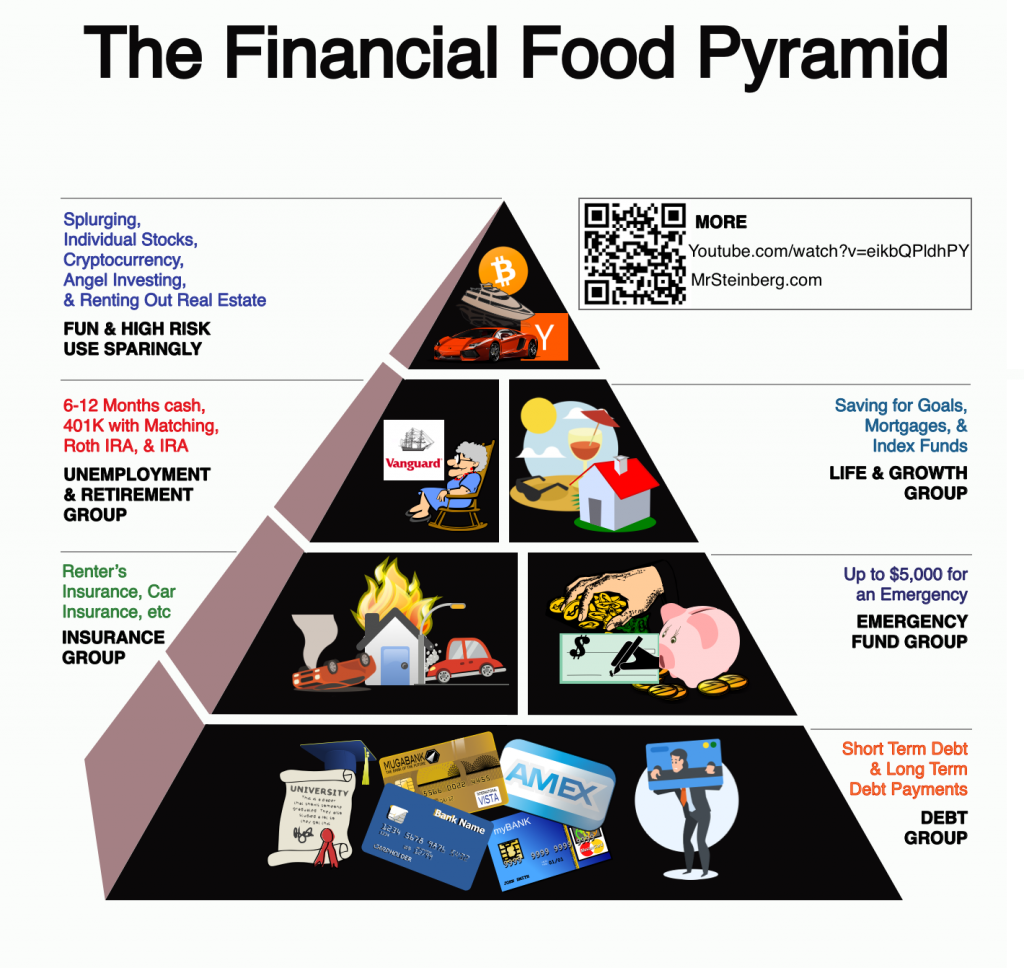

The nutritional food pyramid is taught to kids everywhere, but I have never seen a financial food pyramid.

I learned the hard way what priority to put my money towards as I went deeply into debt to having more savings than I know what to do with.

Here it is in easy to save or share form:

Top Priority

The Debt Group

This is all debts you have to pay or you will get further in debt forever. All short term debt like credit card payments need to be paid on time. If you can’t pay this off yet, get to a position where you can before worrying about your retirement.

I also included the minimum payments on long term as well. This is commonly for things like student loans.

High Priority

The Insurance Group

This insurance for any assets or risks you may have. Car Insurance. Renter’s Insurance. You should look into insurance for anything that would devastate you financially if something happened.

I had no idea Traveller’s insurance and Renter’s insurance was thing. It turns out it is extremely cheap and would have saved me thousands of dollars when most of stuff was stolen in Hong Kong. I coincidentally documented everything that was stolen here: https://mrsteinberg.com/when-to-be-minimalist/

If I had the insurance, the claims would have extremely easy with this article. 🙁

The Emergency Fund Group

This is an amount you can pick that should be in a checking or savings account so you can quickly access it if you need it. The rainy day fund. The amount is up to you, but anything over $5,000 would be excessive.

Note: The two groups here are of questionably equal importance. This is the same spot in the food pyramid where fruit and vegetables go. The same way people debate over how healthy fruit is compared to vegetables, there is some debate over whether having an emergency fund is actually as important as insurance.

Important

If you reached here with your savings, congratulations!

You are no longer in a poor financial situation. You are now working on having a great future.

The Unemployment & Retirement Group

This is about two things.

- Having enough money to give you time for a new job or source of income if something happens

Something can and will happen. Industries change, companies fail, pandemics happen, no job is truly secure. I assumed my job was safe when I made the company $50 million in revenue in a single year. If you have 6-12 months of living expenses saved, you don’t need to be anxious wondering what might happen.

2. Maximizing the tax advantaged money

This is free money.

If your company matches your 401k, there is no reason to not max that out. IRA/401k accounts let you delay when you pay the tax. This can be to your advantage if you will make less money in your retirement. Roth accounts let you pay the tax now and not have to pay no matter how large it grows. Peter Thiel infamously bought his paypal founder shares with his Roth IRA. He owed no taxes on his enormous exit. If you are not sure which to max out between IRA and Roth IRA, I would just do the Roth account.

When you invest, you still have to pick what mutual or index fund to put your money into. You can’t go wrong with Vanguards Indexes, they have basically no fees. If you use their target retirement accounts, you just pick the one with the year you will likely retire and forget about it until then. You can also look at their global and international funds.

The Life & Growth Group

This group is about responsibly growing and using your money for a future before your retirement.

- Saving for Goals

Have a vacation in mind? A hobby you have always wanted to pursue but need to save up for? This could be a child’s college tuition or simply going to Disney Land for a weekend.

2. Mortgages

This is getting a mortgage for a property you are going to live in. I put this in a different category as paying down other long term debt because the interest is typically lower and the investment is safer and may even grow while you live in it.

3. Index Funds

These are the same funds you use for you retirement account, but after you maxed them out for the year. There is no tax advantage to this, it is just a fairly safe way to grow your money instead of holding it all in cash.

Use Sparingly

This is the fun stuff that might increase your net worth.

You can YOLO into a penny stock and share it with Wall Street Bets (https://old.reddit.com/r/wallstreetbets/)

You can invest in a friend’s company. You can own a bar or that food truck you dreamed of since you were a kid. You can buy a sports car that will immediately lose most of its value once you drive it off the lot. You can go to Vegas and put it all on red.

These are the fun ways to spend your money that aren’t financially responsible but give you enjoyment and have a small chance of paying off.

Extra

I also added a QR code and link to my favorite financial advice youtube video: https://www.youtube.com/watch?v=eikbQPldhPY